When I make a backorder on Namejet, the first thing I check is that how many backorders were already placed on that domain. If I am alone, instead of being happy, I start worrying that it was a mistake. When there are hundreds of backorders, I almost give it up before the auction starts. Someone will bid too much from so many bidders, no chance. I like auctions with 10-30 backorders, since I feel than the domain is worth buying it and there is a chance that the price will be acceptable. So it is not rocket science that there is a relationship between the number of bids and the maximum bid. But how strong is this relationship? What kind of function do we have here? I decided to try to answer these questions.

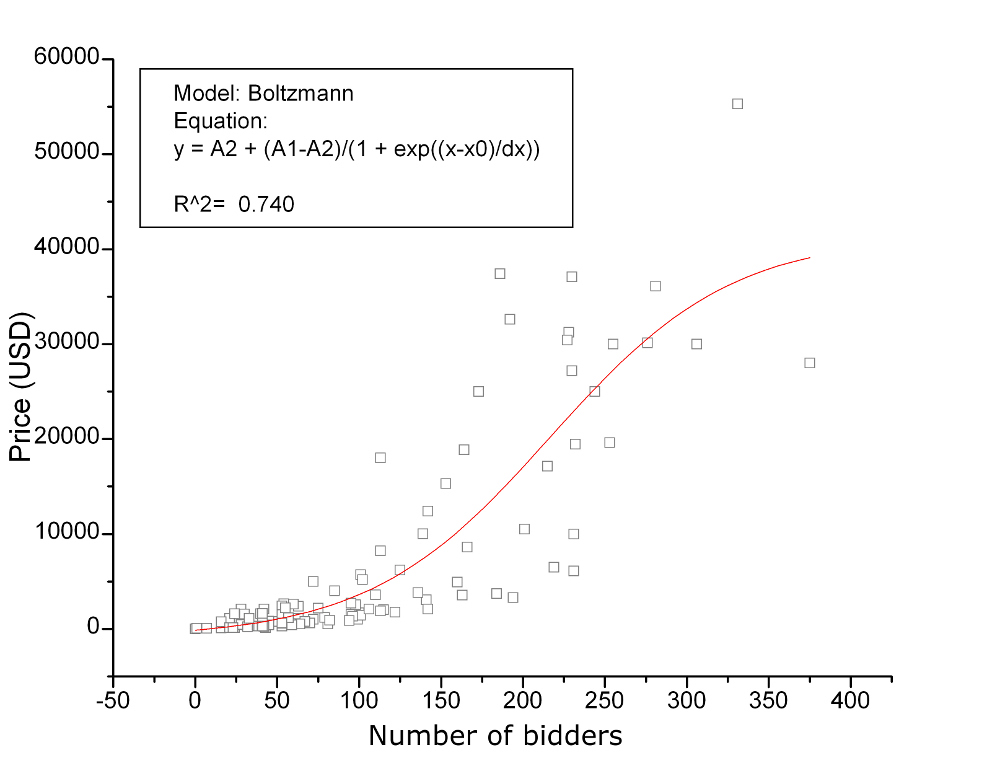

First, I have downloaded the results of the last 3 month Namejet auctions where we participated and reserve met (113 auctions) and collected the number of bids for those auctions. Next, I made a scatter plot for Price vs Bids. Since I realized that the plot follows a Boltzmann distribution, I have calculated ideal Boltzmann distribution function parameters to optimize the fit. Check the curve and points below!

It is not a science blog so don’t want to discuss this further but an R^2=0.74 means a strong correlation between price and bids, so strong that the price can be predicted from the single parameter, number of bids (backorders). This relationship is true until the number of bids are not influenced by an external factor. There are two possible scenario that came to my mind that limits the “freedom” of the number of bids, therefore this correlation will not true anymore:

- high reserve price. A lot of low bidders will not participate, since they are only interested in the domain for $100 or so. E.g. there was an auction with a reserve $700 for a not that great domain and there were only 10 backorders. Usually 10 backorders will mean basic price but here they knew that they must bid above $700.

- high end domains. When we are in the field of 2 letter coms and 2-3 digit numbers than lot of users realize that they have exactly zero chance to get a domain like that, so the number of bids are even lower for the extraordinary valuable (6 figure) domains.

Back to the correlation for one thought. Of course there are cases when 2 or 3 bidders really want the domain, so much that they are not interested in anything, they will buy it for any price. But oppositely what lot of domainers think about this, it does not happen frequently. There is almost always an alternative domain, if the price is too high bidders quit without problem. Bidding wars above the market price don’t happen often. This is the second thing the function can be used for: you can identify if you are above the curve, it is time to leave.

I made a simple calculator based on the optimized function, so anyone can predict the final price of a Namejet auction from the number of bidders if the number of bids is not limited. Feel free to test it below!

Update:

In order to check the validity of the above model, ten recent auctions were analyzed (as external data set). Below you can find a table comparing actual and predicted sales price of ten recent auctions. The results are very good the predicted and actual sales prices are in the same range. Of course, that does not mean a 100% prediction accuracy. Ruca.com was the one with the greatest observed mistake. This is probably because the prices of 4 – letter domains are more defined while many domainers would like to backorder it.

[table id=”33″ /]

Thanks Zsolt for the great information. Personal value indicators are always the final determinate of domain price and that can’t be calculated, but you did a great job showing the resulting data. We all just got a little smarter 🙂 Keep up the good work.

Thank you for the comment. Of course there are personal factors that cannot be predicted besides the factors which can.

Anyone that runs a regression analysis and shares the results like you’ve done gets kudos in my book. If you’re heading to NamesCon, there’s a beer waiting for you. Find me there!

Thanks Michael- unfortunately I will not be around this time, but hope to meet you personally in the next event.

In the title you say number of back orders, but in the chart it says number of bids. I just wanted to confirm that you used the number of bidders and not the number of bids. I don’t think I’ve ever seen a NameJet auction with 350+ back orders, for example 701.com had 215 bidders and LTD.com had 261 bidders.

I really enjoy your blog, keep up the great work.

Thanks Michael for the comment – Indeed, the graph presents the number of bidders, not the bids, I will fix it soon.. Indeed, such a high number of bidders is very rare, as an example, bigdeals.com had 327 bidders and 369 bids, but mostly the number of bidders is below 250.

Great analysis- the chart alone speaks volumes!

Zsolt,

I wanted to say thanks for sharing this market analysis. One can always keep learning about this industry. If you can handle more than one beer please look me up as well at NamesCon 😉

Cheers

Ken,

Unfortunately I will not be there- but I do plan the next event, where I would be happy to meet you. Hopefully I will not get drunk from the beers 🙂

You beat me to the punch, Zsolt. Later I’ll publish some related studies, and we can compare results. A critique from you then would be very welcome.

Joseph, sure, thanks for letting me know about your plan to publish some related studies – I will definitely analyze your results and compare with mine.