To characterize the buyer pool of a domain marketplace, the best indicator is the domain usage. Domains can be bought for many reasons, among those developing a website is the most white hat one. In this post, we analyze BrandBucket in terms of what’s happening with the domains sold there. The 678 sold domain names published on TLDInvestors.com is used for the analysis. Since this list is two years old, these domains were bought at least two years ago, so every buyer had time to develop and start a website on it.

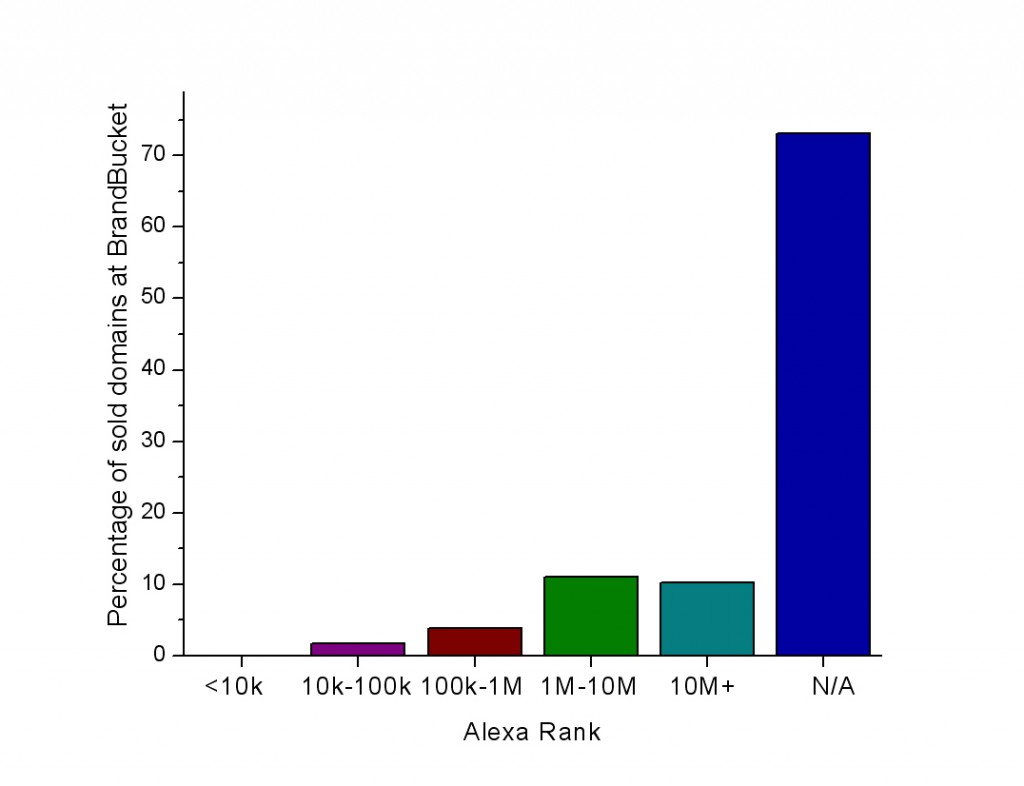

Brandbucket positions itself as providing brandable domains to end users. Let’s see what these end users do with the domains in two years. While it is by far not the sole metrics, traffic is at least a requirement for success. The easiest way to get an impression about the traffic of a given domain is checking its Alexa rank. Domains were grouped by their Alexa rank and the percentage of the number of domains in different groups is shown below (histogram).

As it is indicated on the figure, more than 70% of these domains are unvisited. considering that these domains cost between $1,000 and $2,500 on average, it is a really high number. Additionally, another 10% has an Alexa rank over 10 million, which still means a traffic very close to zero. Altogether 83% of the sold domains have no or very little traffic. Ranks between 1M and 10M is quite uncertain in Alexa, it can mean from daily 10 visitors to sometimes even 1,000 visitors a day. Of course this is a huge difference when we are talking about earning potential. But usually this region means low traffic, which does not justify spending thousands on a domain name. It is still true for domains with an Alexa rank between 100k-1M that the traffic can be relatively low, 20-30 a day but it is also possible that the traffic reaches 10,000 a day in this range.

There is no domain in Alexa top 10k, so there is no extraordinary huge success on this list. 1.8% of the domains are in range between 10k and 100k, which is 12 domains listed in the table below.

| domain name | Alexa rank | website type |

|---|---|---|

| jigsy.com | 11710 | free website builder |

| redbooth.com | 12187 | online project management web application |

| besaba.com | 25643 | free website hosting |

| andromo.com | 45123 | android app creator |

| mattermark.com | 49111 | investor finder |

| pixoto.com | 53342 | photo contest |

| fluidui.com | 76599 | mobile app designer |

| itmo.com | 79197 | Chineze game portal |

| meximas.com | 81051 | the same as besaba.com |

| sonobi.com | 86346 | advertising marketplace |

| hatchbuck.com | 92113 | sales and marketing web application |

| mondovo.com | 97922 | seo and social media web application |

For the first sight it is very interesting that almost all websites in this top list are a web application or software. There is no content website or blog at all among BrandBucket sales in the Alexa top 100k. There are two plausible explanations:

- app developers are funded by investors and they have money to spend on domain name and marketing of a brandable domain

- brandable domains are not well suited for content websites and blogs because without keyword it is harder to get good organic rankings

Anyhow, the only domain where I could surely find out what website running on it is andromo.com. It means that developers have to spend a lot to brand their name and let internet users know what their brand name means. On the other side, it makes trademarking much easier than for an English dictionary word.

After having a look on the domains sold on BrandBucket, we can conclude that these names are perfectly suited for web application developers backed by investors, while others should think twice before spending thousands and suffering with brandable names.